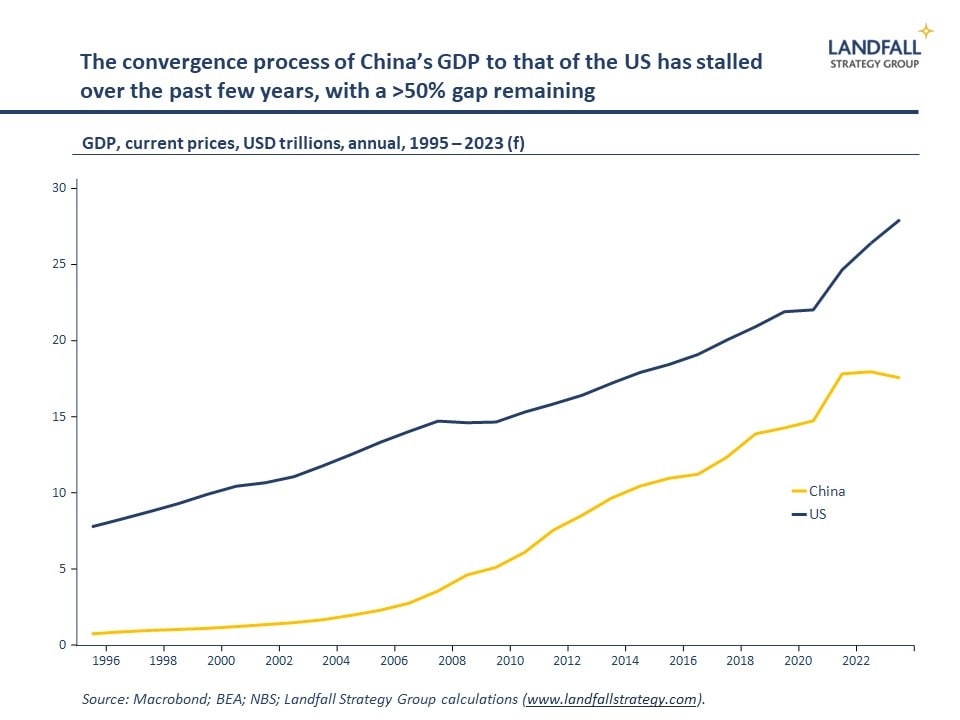

USA v China: China’s GDP convergence process towards the US has slowed, with the US around 50% larger in nominal terms; contributing more GDP growth and import demand.

Measured at market exchange rates, China’s GDP was $18.3 trillion in 2022, 73 percent of the GDP of the United States and 10 times more than the 7 percent of US GDP it registered in 1990. China’s per capita income is now roughly $13,000, approximately 17 percent of US per capita income—compared with less than 2 percent in 1990. Over the past decade and a half, China has been the main driver of the world’s economic growth, accounting for 35 percent of global nominal GDP growth, while the United States accounted for 27 percent.

China’s economic performance has relied largely on investment growth financed by an inefficient banking system. This pattern intensified after the global financial crisis that began in 2008. Increased investment accounted for about two-thirds of GDP growth during 2009–10. Because China is a labor-rich economy and has a capital-to-labor ratio much lower than that of advanced economies, more rather than less investment is probably desirable. However, much of the investment has been driven by the public (state) sector rather than the nongovernmental sector. This is not inherently a problem. Investment in private sector firms, especially smaller ones, can be much riskier than in large, state-owned enterprises. But in China, state-owned enterprises, which collectively receive a disproportionate share of bank credit, typically have not generated strong returns on those investments.